Owner financing, also known as seller financing, is a method where the seller of a property provides financing to the buyer directly, bypassing traditional mortgage lenders1. This can be a great option for buyers who may not qualify for conventional loans due to credit issues or other financial constraints. The seller essentially becomes the lender, and the buyer makes payments directly to them.

For more detailed information, you can visit Forbes.

How Does Owner Financing Work?

In owner financing, the buyer and seller agree on the terms of the loan, including the interest rate, repayment schedule, and the consequences of default1. The buyer typically makes a down payment and then pays the remaining balance over time, similar to a traditional mortgage. However, the interest rates might be higher, and the repayment period shorter.

For more insights, check out Investopedia.

Benefits of Owner Financing

Flexibility: Owner financing offers more flexible terms compared to traditional loans1. Faster Closing: Without the need for bank approval, the closing process can be quicker1. Credit Accessibility: It can be easier for buyers with poor credit to secure financing1.

For more benefits, visit NerdWallet.

Risks of Owner Financing

Higher Interest Rates: The interest rates are often higher than those of traditional mortgages1. Shorter Repayment Terms: The repayment period is usually shorter, often requiring a balloon payment at the end1. Potential for Default: If the buyer defaults, the seller may have to go through the foreclosure process1.

For more risks, see Chase.

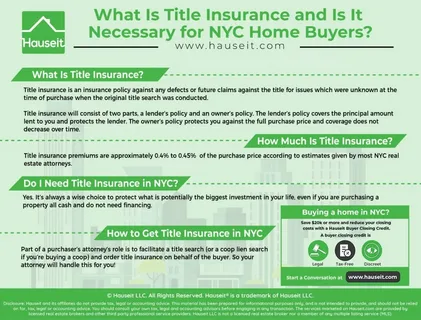

What is Title Insurance?

Title insurance is a policy that protects against financial loss from defects in the title to a property2. It ensures that the buyer has clear ownership of the property and that there are no hidden claims or liens.

For more details, visit Forbes.

Why Do You Need Title Insurance in Georgia?

In Georgia, as in many other states, title insurance is crucial because it protects both the buyer and the lender from potential legal issues that could arise from disputes over property ownership2. It covers problems that were not discovered during the initial title search, such as unpaid taxes, liens, or conflicting wills.

For more information, check out NerdWallet.

Types of Title Insurance

Lender’s Title Insurance: This policy protects the lender’s interest in the property2. Owner’s Title Insurance: This optional policy protects the buyer’s equity in the property2.

For more on types of title insurance, visit Investopedia.

How Much Does Title Insurance Cost?

The cost of title insurance can vary, but it is typically a one-time fee paid at closing. In Georgia, the cost can range from a few hundred to a few thousand dollars, depending on the property’s value2.

For more cost details, see NerdWallet.

Should You Get Title Insurance with Owner Financing?

While title insurance is not always required with owner financing, it is highly recommended. It provides peace of mind and financial protection against unforeseen issues that could arise after the purchase2.

For more recommendations, visit Forbes.

Conclusion

Owner financing can be a viable option for those who cannot secure traditional financing. However, it comes with its own set of risks and benefits. Title insurance, while optional, is a wise investment to protect your financial interests in the property. Always consult with a real estate professional to understand the best options for your specific situation.

Most Vist Information Zekul.net Cixiq.net Ucejat.net Ijofed.net Jhanak.sbs