Oden Insurance is a comprehensive insurance provider that offers a wide range of coverage options to meet the diverse needs of its clients. Whether you’re looking for health insurance, auto insurance, home insurance, or life insurance, Oden Insurance has got you covered. In this article, we’ll dive deep into the various aspects of Oden Insurance, providing you with all the information you need to make an informed decision.

What is Oden Insurance?

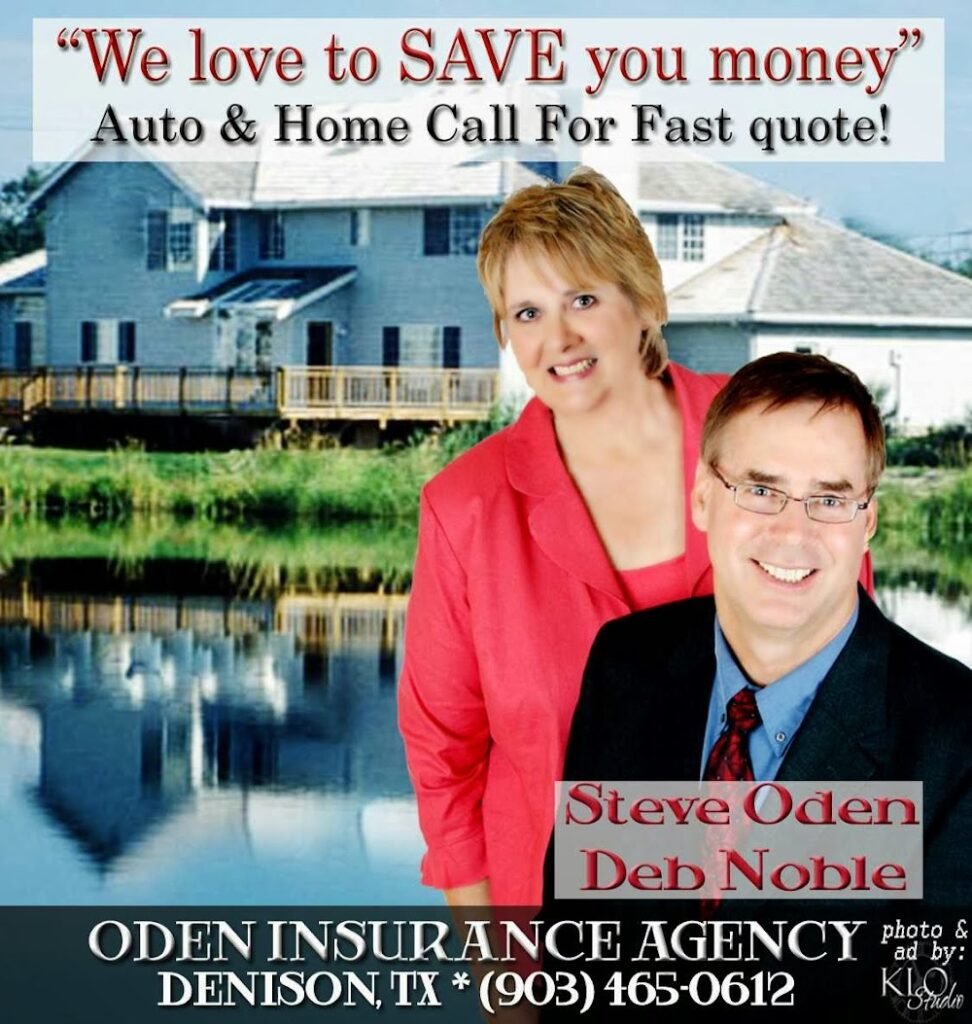

Oden Insurance is a well-established insurance company known for its customer-centric approach and extensive coverage options. They offer policies that cater to individuals, families, and businesses, ensuring that everyone can find a plan that suits their needs. With a strong reputation for reliability and excellent customer service, Oden Insurance has become a trusted name in the industry.

Types of Insurance Offered by Oden Insurance

Health Insurance

Health insurance is one of the most critical types of coverage you can have. Oden Insurance offers a variety of health insurance plans that cover everything from routine check-ups to major surgeries. Their plans are designed to provide comprehensive coverage, ensuring that you and your family are protected in case of medical emergencies.

Auto Insurance

Auto insurance is essential for anyone who owns a vehicle. Oden Insurance provides a range of auto insurance policies that cover everything from liability to comprehensive coverage. Whether you have a new car or an old one, Oden Insurance has a plan that will suit your needs and budget.

Home Insurance

Your home is one of your most significant investments, and it’s essential to protect it. Oden Insurance offers home insurance policies that cover a wide range of risks, including fire, theft, and natural disasters. With Oden Insurance, you can have peace of mind knowing that your home is protected.

Life Insurance

Life insurance is crucial for ensuring that your loved ones are taken care of in the event of your passing. Oden Insurance offers various life insurance policies, including term life, whole life, and universal life insurance. These policies provide financial security for your family, helping them cover expenses and maintain their standard of living.

Why Choose Oden Insurance?

Comprehensive Coverage

One of the main reasons to choose Oden Insurance is their comprehensive coverage options. They offer a wide range of policies that cover various aspects of your life, ensuring that you are protected in all situations.

Affordable Premiums

Oden Insurance is known for offering affordable premiums without compromising on coverage. They have plans that fit different budgets, making it easier for everyone to get the protection they need.

Excellent Customer Service

Customer service is a top priority for Oden Insurance. They have a dedicated team of professionals who are always ready to assist you with any questions or concerns you may have. Their commitment to customer satisfaction sets them apart from other insurance providers.

How to Choose the Right Oden Insurance Plan

Choosing the right insurance plan can be overwhelming, but Oden Insurance makes it easier with their user-friendly website and knowledgeable agents. Here are some tips to help you choose the right plan:

Assess Your Needs

The first step in choosing the right insurance plan is to assess your needs. Consider factors such as your age, health, lifestyle, and financial situation. This will help you determine the type of coverage you need.

Compare Plans

Oden Insurance offers a variety of plans, so it’s essential to compare them to find the one that best suits your needs. Look at the coverage options, premiums, and benefits of each plan before making a decision.

Consult an Agent

If you’re unsure about which plan to choose, consider consulting an Oden Insurance agent. They can provide you with personalized recommendations based on your specific needs and preferences.

Frequently Asked Questions about Oden Insurance

What is the claims process like with Oden Insurance?

The claims process with Oden Insurance is straightforward and hassle-free. You can file a claim online or through their customer service hotline. Once your claim is submitted, a representative will guide you through the process and keep you updated on the status of your claim.

Are there any discounts available with Oden Insurance?

Yes, Oden Insurance offers various discounts to help you save on your premiums. These discounts may include multi-policy discounts, safe driver discounts, and more. Be sure to ask your agent about any available discounts when you sign up for a policy.

Can I customize my Oden Insurance policy?

Absolutely! Oden Insurance allows you to customize your policy to fit your specific needs. You can add or remove coverage options, adjust your deductibles, and more to create a policy that works for you.

Conclusion

Oden Insurance is a reliable and customer-focused insurance provider that offers a wide range of coverage options to meet your needs. With their comprehensive plans, affordable premiums, and excellent customer service, Oden Insurance is an excellent choice for anyone looking for quality insurance coverage. Whether you need health, auto, home, or life insurance, Oden Insurance has a plan that will suit your needs and provide you with peace of mind.

For more information, visit their official website or contact their customer service team. Remember, having the right insurance coverage is essential for protecting yourself and your loved ones, so don’t wait—get covered with Oden Insurance today!

Most Vist Information Zekul.net Cixiq.net Ucejat.net Ijofed.net Jhanak.sbs