Check insurance status of a vehicle ga present day-day rapid-paced international, making sure that your car is properly insured is important. Whether you are looking for a brand new automobile, promoting your vintage one, or certainly need to verify your coverage recognition, information how to test the coverage recognition of a automobile in Georgia is crucial. This entire guide will stroll you via the steps to test your vehicle’s insurance fame, provide recommendations on what to do in case your coverage has lapsed, and provide insights into the significance of maintaining legitimate insurance.

Why Checking Your Vehicle’s Insurance Status is Important

Legal Requirements

In Georgia, it is compulsory to have legitimate vehicle coverage to legally electricity at the roads. Driving without coverage can bring about hefty fines, license suspension, and even car impoundment. Therefore, frequently checking your insurance reputation ensures you are compliant with u . S . A . Crook recommendations.

Financial Protection

Auto coverage gives monetary protection in case of injuries, robbery, or harm. Without insurance, you’ll be responsible for large out-of-pocket charges. Regularly verifying your coverage recognition lets in you avoid sudden financial burdens.

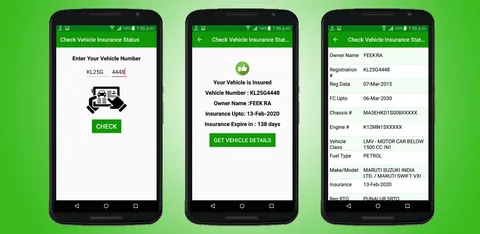

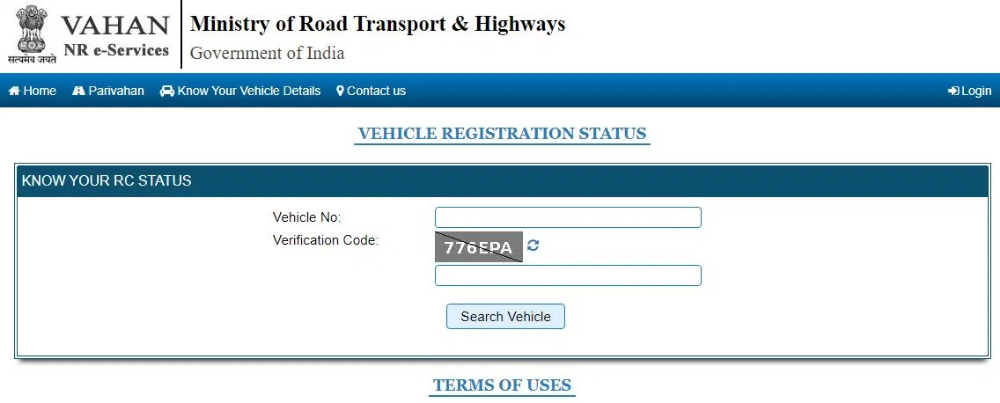

How to Check Your Vehicle’s Insurance Status

Online Methods

- Georgia Department of Revenue (DOR) Website

- Visit the Georgia DOR website.

- Navigate to the “Motor Vehicle” segment.

- Enter your vehicle’s details, along facet the VIN (Vehicle Identification Number) and registration code huge range.

- The tool will show your modern-day-day insurance recognition.

- Georgia Electronic Insurance Compliance System (GEICS)

- Access the GEICS portal.

- Enter the desired facts, at the side of your vehicle’s VIN and license plate range.

- The portal will provide your coverage popularity and any discrepancies that want to be addressed.

Offline Methods

- Contact Your Insurance Provider

- Call your coverage agency immediately.

- Provide your insurance variety and car info.

- The representative will affirm your insurance reputation and provide any vital documentation.

- Visit a Local DMV Office

- Go in your nearest Department of Motor Vehicles (DMV) place of business.

- Provide your car’s VIN and registration code amount.

- The DMV personnel will take a look at your coverage reputation and help with any problems.

What to Do If Your Insurance Has Lapsed

Immediate Steps

- Contact Your Insurance Provider

- Reach out for your coverage corporation immediately.

- Discuss options for reinstating your coverage or buying a new one.

- Avoid Driving

- Do now not force your car until your coverage is reinstated.

- Driving without coverage can result in intense effects.

Long-Term Solutions

- Set Up Automatic Payments

- Arrange for computerized payments to make sure your insurance costs are paid on time.

- This allows save you lapses in coverage.

- Regularly Review Your Policy

- Periodically assessment your coverage coverage to make sure it meets your wishes.

- Make modifications as important to hold accurate sufficient coverage.

The Importance of Maintaining Valid Insurance

Peace of Mind

Having legitimate coverage gives peace of thoughts knowledge that you are included in case of an twist of fate or tremendous sudden sports. It lets in you to electricity hopefully, understanding which you are financially blanketed.

Legal Compliance

Maintaining legitimate coverage guarantees you’re continuously compliant with Georgia’s crook requirements. This enables you keep away from fines, consequences, and wonderful jail problems.

Conclusion

Regularly checking the coverage repute of your automobile in Georgia is a easy yet important venture. By following the steps outlined on this guide, you could ensure that your automobile is constantly properly insured, presenting you with monetary protection and peace of thoughts. Remember, maintaining legitimate coverage is not just a prison requirement however additionally a clever financial selection.

For extra facts, go to Zekul.Net, Cixiq.Net, Ucejat.Net, Ijofed.Net, and Jhanak.Sbs.